Applied Economics vs Financial Economics: Key Differences

Applied economics and financial economies are not the same.

Request Information

The main difference between applied economics and financial economics is that applied economics focuses on using economic theory to solve broad real-world problems across various sectors, while financial economics deals with financial markets, investments, and risk management.

Economics influences everything around you, from the price of your morning coffee to global trade agreements. Far from being just about money, it helps us understand how societies function, how resources are allocated, and how goods and services flow through an economy.

Because of this vast scope, economics branches into various specialized areas. Among these are applied economics and financial economics, two distinct paths that offer unique approaches to solving economic problems.

Upon exploring applied economics vs. financial economics, it'll become clear that while both belong to the same field, they differ significantly.

What is Applied Economics?

Applied economics, as its name implies, refers to the application of economic theory and principles to real-world issues. In this branch of economy, economists use data and economic frameworks to analyze, interpret, and propose solutions to practical problems.

It is one thing to know the basic principles of economics. It is another to apply them to the problems of the real world.Thomas SowellProminent American Economist

What Thomas Sowell is getting at is that understanding economic theory in the abstract is only half the work. The true test comes when those principles must be adapted and applied to the messiness of reality, where variables don't behave as expected, and the human element introduces challenges that models can't always predict.

Economists specializing in this field aim to analyze the incentives, constraints, and unintended consequences of policies, ensuring decisions are based on thorough consideration of long-term effects rather than immediate outcomes.

What is Financial Economics?

Financial economics, on the other hand, is the branch of economics that focuses on financial markets and the interactions between the economy and financial systems. It covers areas like how stocks, bonds, and other financial assets are priced, how financial institutions operate, as well as how risk and return influence decision-making in financial markets.

Understanding the relationship between risk and return—basically, how much risk someone is willing to take to earn a certain amount of money—is a key part of financial economics. For example, investing in stocks can be risky because their value goes up and down, but they also offer the potential for higher returns compared to safer investments like savings accounts.

The most important function of financial economics is the allocation of resources in an uncertain environment.Robert C. MertonNobel laureate

Financial economics also addresses financial crises by analyzing systemic risks and how financial institutions respond to periods of stress, offering insights into how policies can be designed to mitigate the impact of such crises on the broader economy.

Differences Between Applied Economics and Financial Economics

It's important to understand the distinction between applied economics and financial economics because, while both fields share a foundation in economic theory, they address very different areas of expertise and practice.

Recognizing the differences can also help if you're looking to pursue a career in economics and are unsure which branch you want to focus on.

Educational Requirements and Qualifications

The educational requirements for both applied economics and financial economics are typically quite similar at the undergraduate level. Students usually begin with a Bachelor's in Economics or Finance as it helps them build a solid knowledge base, upon which they can later specialize in their chosen branch of economics.

It's also common for students interested in finance to pursue a B.B.A. in Finance or a B.B.A. in Banking and Finance, as these degrees equip students with the fundamentals needed to advance into graduate programs focused on either applied or financial economics.

Later on, for those looking to focus on applied economics, many pursue a Master of Science in Applied Economics and Predictive Analytics (MSAEPA). This graduate degree focuses on applying economic theories to real-world data, with a particular emphasis on econometrics and quantitative methods. At UND, for instance, the MSAEPA (Master's in Applied Economics & Predictive Analytics) program includes key courses such as:

- Economic Forecasting

- Econometrics

- International Money and Finance

- Demographic Methods for Economists

- Quantitative Methods for Impact Evaluation and Causal Inference

- Microeconomic Theory and Applications

Kenneth Cowles, a UND alumnus and now a Research Assistant at the Opportunity & Inclusive Growth Institute at the Minneapolis Federal Reserve, shared that the reason why he chose UND's MSAEPA program was precisely the coursework.

It was data and econometrics intensive and I felt these types of courses would set me up for success. I can honestly say that after every course I learned something I could apply to the real world.Kenneth CowlesUND Alumni

Students aiming to specialize in financial economics require a more focused education centered on finance and market operations. Many professionals in this field opt for a Master of Science in Finance (MSF) or a Master of Business Administration (MBA) with a finance concentration. These programs typically include courses such as:

- Corporate Finance

- Asset Pricing

- Investment Analysis

- Risk Management

- Derivatives and Financial Instruments

Furthermore, to advance in various financial roles, obtaining certifications such as Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM) is highly valued in the financial industry. Similarly, those interested in applied economics can benefit from various certifications, like UND's Applied Economics graduate certificate.

Focus and Scope

The scope of applied economics is quite broad and diverse. That's because applied economics addresses issues across various sectors, including healthcare, housing, labor, education, and environmental policy. Applied economists use economic theories and data to find solutions for societal challenges that affect multiple aspects of public and private life. For example, they might assess the economic impact of new healthcare policies or propose strategies to improve affordable housing initiatives.

In contrast, financial economics has a more specialized focus. It narrows in on the specific workings of financial markets, asset valuation, risk management, and the behavior of financial institutions.

While financial economics plays an important role in managing portfolios, analyzing stock market trends, and evaluating risks associated with financial instruments, applied economics takes a wider, more interdisciplinary approach to solving societal problems.

Methodologies and Tools

Professionals in both applied economics and financial economics rely heavily on analytical and statistical tools to fulfill their responsibilities. However, they generally tend to utilize different methodologies, although this depends on the exact objectives of a project.

In applied economics, professionals typically use:

- Econometric models in order to identify and quantify relationships between variables, such as how government policies affect employment

- Cost-benefit analysis so they can weigh the economic pros and cons of specific interventions or projects

- Tools like R, Stata, and SPSS to process large datasets and make projections

- Survey and field data to support their analyses

In financial economics, the focus is more on financial data and mathematical modeling. Some of the commonly used tools include:

- Monte Carlo simulations in order to model the probability of different outcomes in uncertain financial scenarios

- Value-at-Risk (VaR) models so they can measure the potential loss in value of a portfolio

- Financial derivatives pricing models to assess the pricing of options, futures, and other derivatives

- Portfolio optimization techniques to manage and allocate investments based on expected returns and risk levels.

Applications and Real-World Impact

Applied economics' strength lies in its ability to evaluate how policies impact economic growth, public welfare, and overall societal progress. The practical insights derived from it often lead to reforms in taxation, healthcare systems, labor markets, and environmental policies, creating long-term positive outcomes for communities and governments alike.

Through its application of data and forecasting techniques, applied economics helps decision-makers adjust to economic shifts and implement strategies that drive social benefits and economic resilience.

In contrast, financial economics serves a more targeted purpose within the economy, directly influencing the financial sector's operations. It provides tools and frameworks for risk management, investment strategy, and corporate finance, ensuring financial markets function efficiently.

Its contribution to market stability and growth is seen in how businesses and individuals use its principles to optimize asset management and minimize risks. Furthermore, financial economics has a direct impact on wealth creation by guiding investment decisions that fuel both personal financial health and broader economic activity.

Career Pathways and Opportunities

Professionals in applied economics often work in roles that involve public policy analysis, economic consulting, and research. Some common positions include:

- Policy analyst

- Economic consultant

- Research economist

- Development economist

- Data analyst

- Environmental economist

Financial economics careers are often centered in banking, investment firms, and corporations. Common positions include:

- Financial manager

- Investment analyst

- Risk manager

- Corporate finance analyst

- Financial consultant

- Financial analyst

Which Field Should You Consider?

At the end of the day, while applied economics and financial economics share some similarities, they are two distinct career paths. Choosing between them depends on your interests, career goals, and preferred work environment.

Applied economics may be the better choice if you enjoy tackling societal challenges and working across various sectors, such as healthcare, public policy, and education. Its broader scope allows you to influence a wide range of issues, providing solutions that can lead to long-term societal benefits.

Financial economics, on the other hand, is more suitable for you if you're drawn to financial markets, investments, and corporate strategies. It has a more specialized focus, with direct, measurable impacts on financial performance, market stability, and personal wealth management.

Salary Expectations for Applied Economics vs. Financial Economics

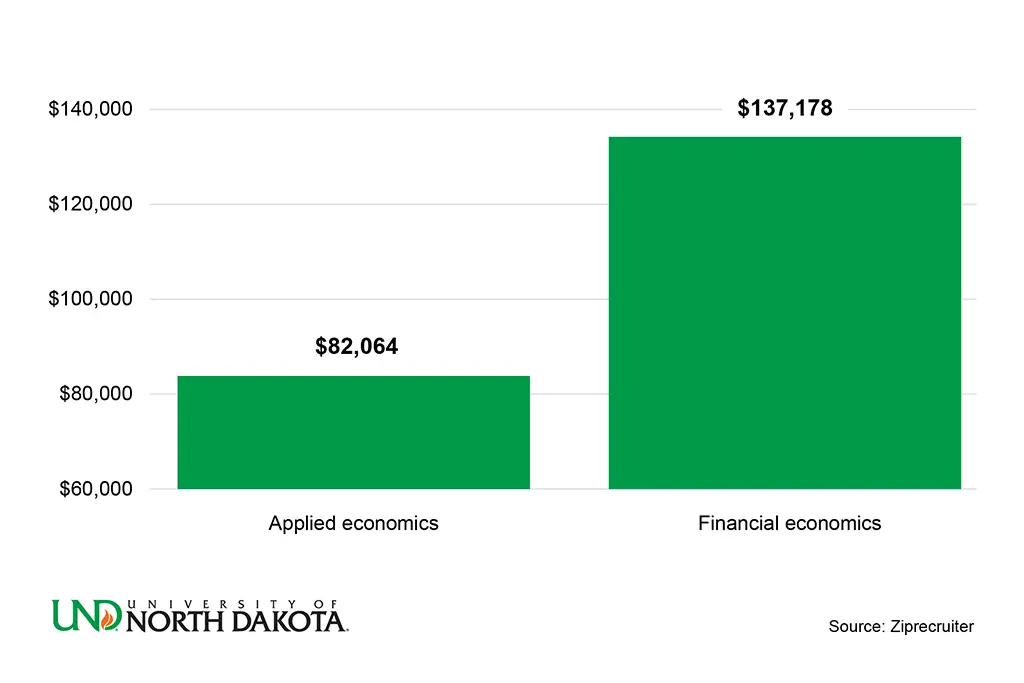

Applied economics offers an average salary of $82,064 per year, while financial economics commands a higher average of $137,178.

This difference in salary makes sense, given the nature of the two fields. Applied economics covers a broader range of sectors and issues, which means salaries can vary widely depending on your job, industry, and location. Some may pay less than others.

On the other hand, financial economics is a more focused, technical branch of economics that deals directly with financial markets, risk management, and investment decisions. These areas are often associated with higher stakes and larger financial outcomes, which leads to higher average salaries.

However, it's important to note that your earnings in either field can vary based on your role, experience, and the specific industry you're in. Both offer plenty of room for growth.

Conclusion

Whether you choose applied economics, with its broad societal impact, or financial economics, with its focus on financial markets, both options offer valuable, rewarding careers that contribute to improving economies and communities. If you're considering a future in economics, UND provides exceptional programs that will equip you with the knowledge and skills needed to thrive in this field. With the right education, you'll be set toward a successful career path.

FAQs

It can certainly be challenging, but with a strong interest in data analysis and real-world problem-solving, it's highly rewarding and worth the effort.

Yes, many applied economics graduates work in finance, especially in roles related to data analysis, policy advising, or financial consulting.