What Can You Do with an Economics Degree? Top Jobs Listed

With an economics degree, you can step into roles like economist, financial analyst, actuary, or market research analyst, among many others. They each enable you to influence business decisions and shape economic policies.

Request Information

Did you know that students who choose to major in economics can see their earnings jump by an impressive $22,000 per year, or 46%, by their mid-twenties? This statistic represents one of the most lucrative returns on investment a student can make.

Imagine the difference in your financial future simply by selecting economics over other social science majors. But the benefits don't stop at higher paychecks; an economics degree, much like the field itself, is incredibly versatile, seeping into virtually every industry where money plays a role. With such compelling evidence of its value, you might wonder, what can you do with an economics degree? The opportunities are endless!.

Jobs You Can Get With an Economics Degree

An economics degree provides a wide array of career opportunities. You can step into some roles right after earning your bachelor's in economics, while more specialized positions may require further education, such as a Master's in Applied Economics & Predictive Analytics.

In some cases, additional certifications or licensure might be needed. But in every instance, the analytical skills and economic insights you've developed will be necessary for the job.

Economist

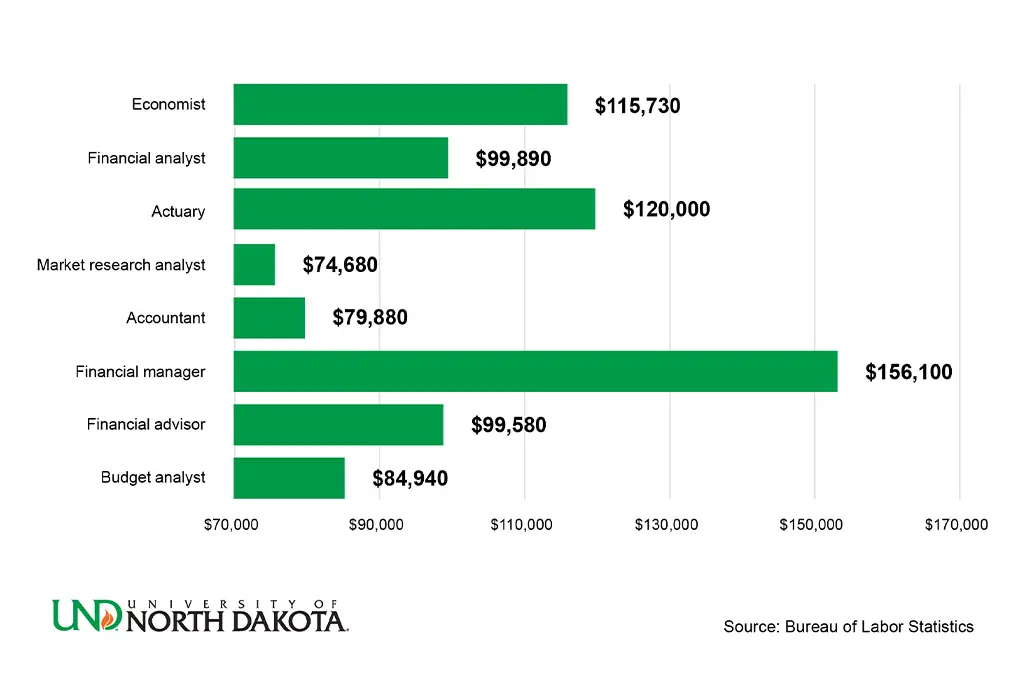

Median salary: $115,730 per year

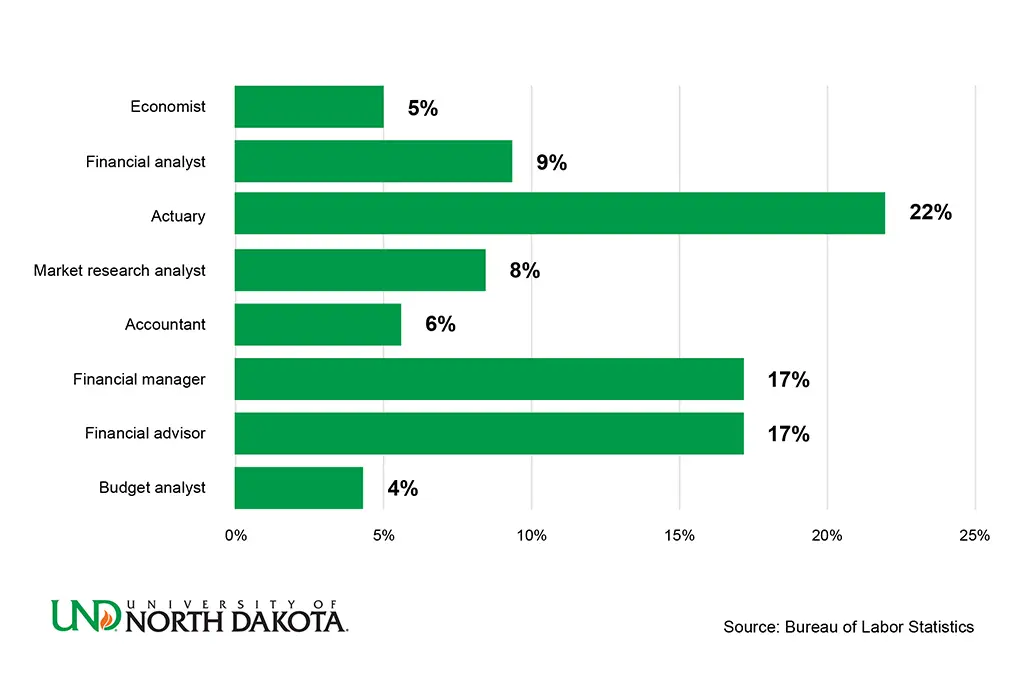

Estimated job outlook: 5% increase

Economists are essentially the analysts of our economy. They dissect complex data to establish how resources and money move within different economic systems. Their day-to-day tasks include conducting in-depth research, assembling key findings into reports, and evaluating significant economic issues such as inflation, unemployment, and monetary policy. Their work helps us understand current economic conditions and offers forecasts of potential future trends.

Economists often hold a master's degree in economics, although some entry-level positions, particularly in government, may be accessible with a bachelor's degree. Those looking to pursue advanced research or academic roles usually go on to earn a Ph.D.

Economists can be found working in various sectors, including government agencies, financial institutions, think tanks, and academia. They may also work for international organizations, private corporations, or nonprofit organizations.

Financial Analyst

Median salary: $99,890 per year

Estimated job outlook: 9% increase

The work of financial analysts requires much more than just crunching numbers. They are the strategists behind investment decisions, helping businesses and individuals make informed choices about where to allocate their money. They analyze financial data, track the performance of various assets, and provide insights that help maximize profits while mitigating risks.

At UND, for example, financial analysts like Morehouse, a former student of the university, contribute to key decisions by analyzing data to optimize the budgeting process under the new MIRA model. Her role involves determining whether additional classes should be opened and projecting student credit hours for upcoming semesters, showcasing how financial analysts directly influence organizational strategy.

A bachelor's degree in finance, economics, or a related field is typically required, and pursuing certifications like the CFA (Chartered Financial Analyst) can further enhance one's career trajectory. With such qualifications, you can work in a range of environments, from banks and investment firms to insurance companies and large corporations.

Actuary

Median salary: $120,000 per year

Estimated job outlook: 22% increase

Actuaries specialize in assessing the financial risks associated with various uncertain events, primarily for insurance companies. They are valued for their proficiency in managing those risks and assuring stability in different situations.

They use mathematics, statistics, and financial theory to calculate the likelihood of events such as accidents, natural disasters, or other unforeseen occurrences. This analysis helps insurance companies set premium rates, develop policy plans, and predict future payouts.

Actuaries typically work full-time in office settings, but those who work as consultants may travel to meet clients. To become an actuary, you need a bachelor's degree and must pass a series of exams provided by the Society of Actuaries (SOA), the American Society of Pension Professionals and Actuaries (ASPPA), or the Casualty Actuarial Society (CAS), in order to gain professional certification.

Market Research Analyst

Median salary: $74,680 per year

Estimated job outlook: 8% increase

Market research analysts are experts in studying consumer behavior, market conditions, and competitive dynamics to help businesses understand what products and services are in demand. They gather and investigate data patterns to assess potential sales, which informs marketing strategies and business decisions.

These professionals work across various industries, including retail, manufacturing, advertising, and healthcare. A bachelor's degree in market research, economics, or a related field is usually a prerequisite for most positions, though some may prefer candidates with a master's degree.

Accountant

Median salary: $79,880 per year

Estimated job outlook: 6% increase

Accountants are responsible for preparing and examining financial records, ensuring accuracy and compliance with regulations. They handle tasks such as tax preparation, financial reporting, and auditing, which are essential for maintaining the financial integrity of businesses and organizations.

Accountants work in public accounting firms, corporations, government agencies, and nonprofits. A bachelor's degree is typically the minimal requirement, allowing them to start practicing without a license. However, these beginning accountants are limited in the titles they can use and the scope of work they can perform.

To use the title Certified Public Accountant (CPA) and take on more advanced duties, they must obtain certification, which significantly improves job prospects and earning potential.

Financial Manager

Median salary: $156,100 per year

Estimated job outlook: 17% increase

Financial managers oversee an organization's financial stability. They create financial reports, direct investment activities, and develop strategies to meet long-term financial goals. These roles often involve managing the financial operations of a company, guaranteeing that all financial practices are aligned with organizational objectives.

Financial managers typically work in the banking, investment, and insurance industries, but they can be found in virtually any sector that requires financial oversight. A bachelor's degree in finance, accounting, or economics is required, along with several years of experience in a financial role.

Financial Advisor

Median salary: $99,580 per year

Estimated job outlook: 17% increase

Personal financial advisors help individuals manage their finances and plan for their future. They provide advice on investments, retirement planning, estate planning, and other financial matters, tailoring their guidance to meet the specific needs of their clients.

These advisors often work for financial institutions, but many are self-employed, offering their services directly to clients. A bachelor's degree in finance, economics, or a related field is typically required, and certifications such as Certified Financial Planner (CFP) can enhance job prospects.

Budget Analyst

Median salary: $84,940 per year

Estimated job outlook: 4% increase

Budget analysts help organizations plan their finances by preparing budget reports and monitoring spending. They ensure that funds are allocated efficiently and that the organization stays within its financial limits. Their role involves evaluating budget proposals, making recommendations, and ensuring that spending aligns with organizational goals.

Budget analysts work in government agencies, private corporations, educational institutions, and nonprofits. A bachelor's degree in finance, economics, or a related field is typically required, with coursework in accounting and statistics being particularly beneficial.

Median Annual Salary with an Economics Degree

Job Outlook with an Economics Degree, 2023 to 2033

Choosing Your Career Path

While the allure of high salaries and impressive job growth statistics might initially draw you to certain roles, making the right choice requires more than just a glance at the numbers. To help narrow down your options, try to:

Start with Self-Reflection

Before you begin to compare job descriptions and market outlooks, take a moment to reflect on what truly excites you. Understanding what drives you is the first step in narrowing down your options. So, ask yourself questions like:

- What tasks do I enjoy?

- What type of work environment do I thrive in?

- Do I prefer working independently or as part of a team?

Research and Explore

Once you have a better understanding of your interests, the next step is to research. Take the time to explore these careers and other options in great detail. Consider not just the salary and day-to-day tasks but focus on the required qualifications and the long-term prospects.

Seek Professional Advice

The best guidance often comes from those who have been in your shoes. So seek advice from professionals in the field of economics, as they have pursued an economics degree and successfully made their own career choices. Talk to professors, career counselors, or other professionals working in the field. They can offer insider perspectives that you might not find in your online research.

Additionally, consider reaching out to alumni from your university who have taken different career paths with their economics degrees. Their experiences can provide you with a realistic view of what to expect and can even help you avoid common pitfalls.

Trust your Instincts

Finally, trust your instincts. Keep in mind that your career takes up a large chunk of your life, and it should be something that brings you satisfaction and fulfillment. While practical considerations like salary and job stability are important, they shouldn't be the sole determinants of your choice.

Conclusion

Once you've made your decision, the last thing left to do is take action, and UND will be here to support you at every step of that process. With our economics programs, including bachelor's and master's programs, as well as the Applied Economics Certificate, you'll be thoroughly prepared for all the roles mentioned above—and many others that align with your ambitions. Start your future with us and redefine what's possible in your career.

FAQs

Absolutely! Economics opens doors to many exciting career paths, with plenty of room for growth and impact. Plus, with strong job outlooks and competitive salaries, it's a field that offers both stability and financial reward.

Yes, an economics degree can lead to impressive earnings, often outpacing other majors, especially as you progress in your career and take on more specialized or senior roles.